Venture Capital is all the rage, Right? Yes!

In London, new research from Dealroom.co and London & Partners revealed that 2020 was a record year, with tech firms raising $10.5bn of VC investment. London has been the second fastest-growing global tech hub since 2016, seeing increasing levels of new VC funds set up, and being home to the highest concentration of unicorns and future unicorns in Europe. Whilst once Private Equity was the darling of the City when it came to law firm hiring, VC is stepping up to the plate with an increasing number of our law firm clients talking to us about their desire to either establish or add strength to their VC teams.

Why has this happened? Simply put, VC has potential to provide better returns and be more profitable on a public market equivalence basis. Not to mention of course that the lines between PE and VC continue to blur with PE having to adopt the VC model, better understand technology companies, take more risks and drive growth through diversification. Fundamentally, technology has bridged the gap between PE and VC and the trend is set to continue and probably will accelerate after the Covid-19 pandemic recedes, according to Private Equity News.

So let us turn our attention to what this means in the world of lateral partner recruitment at law firms in London, first by taking a look at some of the key Partner moves over the last 5 years:

2020

| Acquiring Firm | Partner | Hired from |

| Latham & Watkins | Shing Lo | Bird & Bird |

| Latham & Watkins | Mike Turner | Taylor Wessing |

| Reed Smith | Sam Webster | Mayer Brown |

| Brown Rudnick | Neil Foster | Baker Botts |

| Brown Rudnick | Tim Davison | Baker Botts |

| Brown Rudnick | Sarah Melaney | Baker Botts |

2019

| Acquiring Firm | Partner | Hired from |

| Goodwin Procter | Ali Ramadan | Orrick, Herrington & Sutcliffe |

| Goodwin Procter | Adrian Rainey | Taylor Wessing |

| Goodwin Procter | David Mardle | Taylor Wessing |

| Goodwin Procter | Rob Young* | Taylor Wessing |

| Goodwin Procter | Andrew Davis | Taylor Wessing |

| Osborne Clarke | Matthew Edwards** | Inventages |

| Wilson Sonsini Goodrich & Rosati | Stacey Kim | Orrick, Herrington & Sutcliffe |

| Shoosmiths | James Klein | Pennington Manches |

* Rob Young is a tax partner specialising in venture capital transactions

**Matthew Edwards joined from an in-house position at a VC fund manager

2018

| Acquiring Firm | Partner | Hired from |

| Goodwin Procter | Sophie McGrath | Brown Rudnick |

| Bird & Bird | James Baillieu | Norton Rose |

| WithersTech | James Shaw | JAG Shaw Baker |

| WithersTech | Tina Baker | JAG Shaw Baker |

| WithersTech | Erika McIntyre | JAG Shaw Baker |

| WithersTech | Susanna Stansfield | JAG Shaw Baker |

| WithersTech | Ian Cockburn | JAG Shaw Baker |

| Orrick, Herrington & Sutcliffe | Ali Ramadan | Bird & Bird |

Note – Withers acquired JAG Shaw Baker, a corporate and Intellectual Property boutique, to create WithersTech

2017

| Acquiring Firm | Partner | Hired from |

| Shoosmiths | Steve Barnett | Orrick, Herrington & Sutcliffe |

| Browne Jacobsen | Jon Snade | Irwin Mitchell |

2016

| Acquiring Firm | Partner | Hired from |

| Orrick, Herrington & Sutcliffe | Ylan Steiner | King & Wood Mallesons |

| Taylor Wessing | Angus Miln | Bird & Bird |

| EY Law | Richard Goold | Gowlings WLG |

| Ashfords | Giles Hawkins | Orrick, Herrington & Sutcliffe |

As we can see, there are some clear trends. In general, the amount of lateral hiring of VC Partners has increased steadily since 2016. Another trend which is more clearly seen in 2020 and 2019, is that major US law firms are hiring Partners in this space. Last year Latham and Watkins established a VC practice, hiring Shing Lo and Mike Turner from UK firms. Brown Rudnick also hired three partners from Baker Botts.

In 2019, Goodwin Procter built a sizeable team including taking four partners from UK firm Taylor Wessing. And 2018 saw the much-anticipated arrival of the leading US tech firm, Wilson Sonsini Goodrich & Rosati in London.

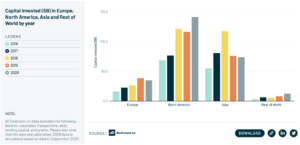

Across the board (with the exception of China, where investment into private technology companies slowed) the size of the market in terms of capital invested into tech, much of it from VCs, has grown steadily, as can be seen below:

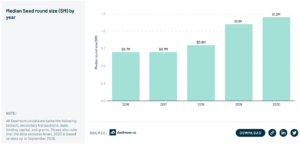

In addition, the leading seed investors are raising larger and larger funds and the arrival of leading US VCs means they are now also participating at seed level in Europe. Sequoia Capital opening an office in London is a clear demonstration of this, and Peter Theil recently spoke about why he is increasingly investing into European tech, having previously dismissed it.

It is therefore no surprise that with growing fundraisings and increased investments that law firms are increasing the size of their VC practices and competing for the best talent. Nor is it a surprise, with increasing US VC presence in Europe alongside increased US activity by UK-based start-ups seeking growth, that US law firms are now extremely interested in this area.

It would be no surprise if 2021 was yet another record breaking one bearing in mind there was of course an initial Covid-19 slowdown in Q2 in 2020, with capital flow and investments grinding to a halt before bouncing back so strongly in Q3. Eileen Burbidge, partner at London VC firm Passion Capital, recently stated (Reuters) that she has been ‘seeing pitches back to pre-COVID levels or higher’. Lateral moves have already started with Erika McIntrye joining Taylor Vinters from WithersTech in January 2021.

However, whilst the future is looking bright indeed, there are likely to be some challenges. There has been a growing trend to focus on Diversity & Inclusion within the VC and technology world, which seems to have a greater disparity than one might naturally assume. This is something that we shall investigate further in a follow-up piece, so keep a look out. In the meantime, it would be great to hear from you: what trends are you seeing in the VC and start-up world? Please feel free to get in touch!

By Syed Nasser, Head of Technology Transactions & Venture Capital

Email: snasser@fidessearch.com

Mobile: +44 (0) 7960 739 158 | Direct Dial: +44 (0) 20 3642 1871