By Mathew Parker, Consultant at Fides Search

Legal work in Data Protection & Privacy has experienced steady growth over the past decade, across the world, as the storage of people’s information, interactions and tendencies has become a regulated and developing market.

Fides Search recently delivered a talent mapping project for a global financial institution who had instructed us to build their legal data protection function. This exercise highlighted that a vast number of lawyers had, over the last 5 years, been promoted to the partnership at their firm or moved to senior in-house roles (click here for link to post).

Considering this, I have reviewed the movement of law firm Partners that practice within the field of Data Protection / Cyber Security, within the London market.

The Market

The need for law firms to offer data protection advice is now well established. The following statistics demonstrate the importance of offering data protection expertise as it is relevant to law firm clients in any number of sectors:

- 88 per cent of UK data breaches are caused by human error.

- Every 14 seconds a business will fall victim to a ransomware attack. In 2021 it is predicted to be 11 seconds!

- Even the least effective training programmes have a 7-fold ROI

- 71 per cent of customers say they would take their business elsewhere after a data breach

- ICO fines can be a huge expense and require massive resource allocation.

In recent years, the UK government has taken significant steps to position the UK as a world leader in data driven innovation. Data has of course played a key part in tracking and tackling the pandemic, further demonstrating how data crosses and touches almost all sectors, whether it be tracking our contacts or tracking our habits for our next food delivery. What this all means is that the UK has a healthy regulatory framework and combined with a government that is very much in favour of having high standards when it comes to data and utilising it to the maximum effectiveness to drive commerce.

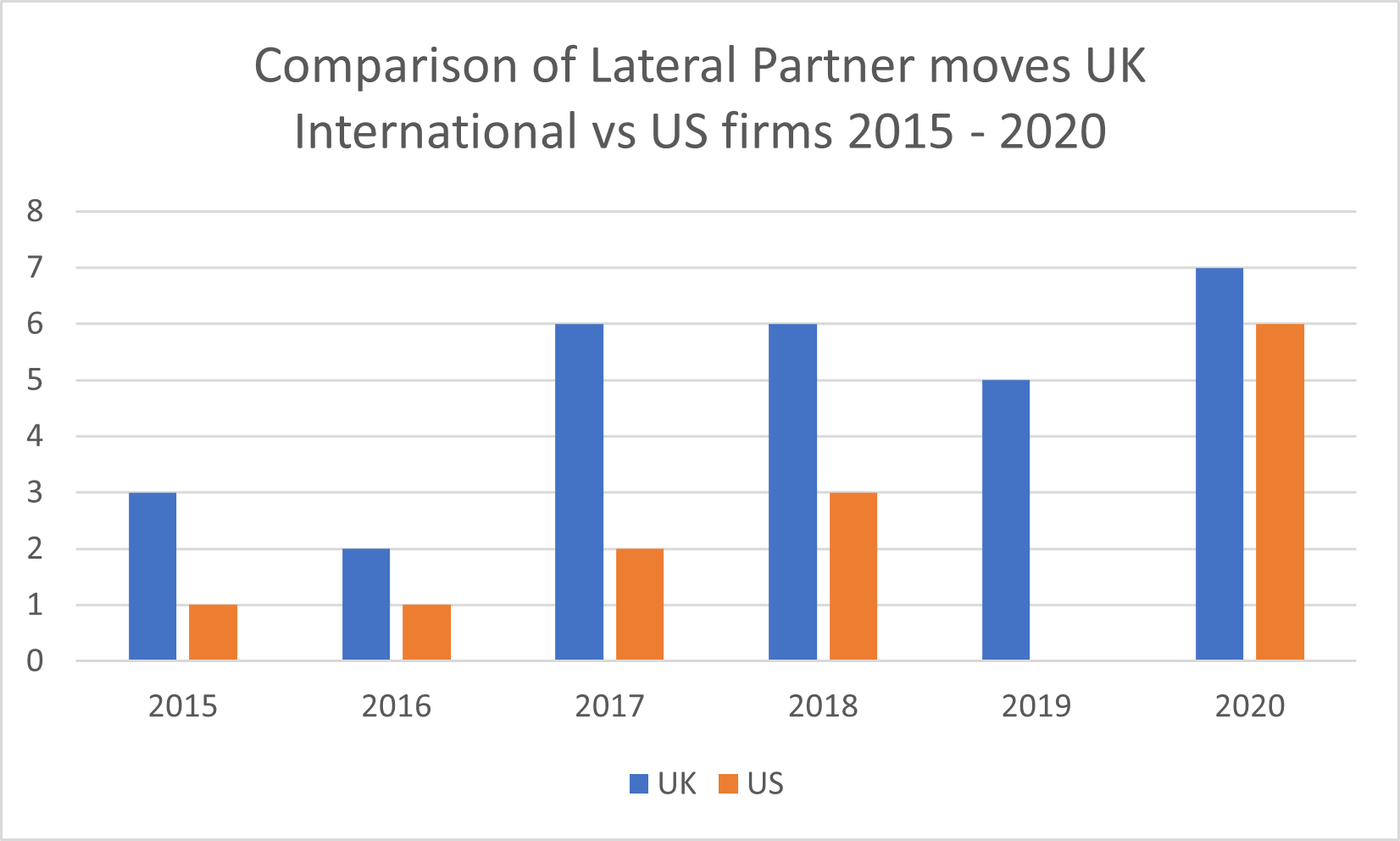

Whilst 2018 was a bumper year for the practice in terms of work levels with GDPR implementation, the ripple in the industry had in fact started the year prior, before which, during both 2015 and 2016, only 4&3 lateral partner moves occurred respectively. In 2017, 8 moves took place with UK/International firms making up 75% of the moves compared to 25% from US Headquartered firms.

This information was gathered via LinkedIn research, moves monitoring sites and law firm announcements.

The trends are clearly linked to regulatory change. 2020 saw several interesting regulatory challenges arise, the Schrems 2 ruling and also the formation of a post Brexit regulation landscape, all stimulating increased work levels and leading to the demand of lateral hires at firms looking to add this practice or add bench strength to their offerings.

It is also important to consider the link with cyber security, and how mass adoption of cloud and web based technologies during the pandemic, whether it be food delivery or establishing the worldwide phenomenon of working from home. We have greatly increased our use of the internet and therefore shared more of our data and the increase in the number of moves in 2020 reflects this.

The US market for data protection is of course somewhat different and evolving quickly as each State has their own data protection regulations and guidelines which create more opportunities when it comes to offering advisory and transactional support which the chart below illustrates as a comparison of UK International firms to US firms.

UK/International firms are responsible for the majority of the lateral moves in London, which is understandable due to the number of firms and an interesting barometer of where the market has been most active from 2015 to 2020 inclusive. Below you can see a year-by-year breakdown:

Below is a list of the partner moves, broken down by year, who offer data protection / cybersecurity in their practice:

2021

| Acquiring Firm | Partner | Hired From |

| Mischon De Reya | Ashely Winton | MWE |

| Harcus Parker | Ryan Dunleavey | Stewarts |

| Cooley’s | Guadalupe Sampedro | Bird & Bird |

2020

| Acquiring Firm | Partner | Hired From |

| DWF | Stewart Room | PWC |

| BCLP | Geraldine Scali | Sidley Austin |

| Pinsent Masons | Jonathan Kirsop | Stephenson Harwood |

| DWF | James Drury-Smith | PWC |

| Spencer West | Mark Gleeson | Knights PLC |

| Baker Mckenzie | Paul Glass | Taylor Wessing |

| Clifford Chance | Simon Persoff | DLA Piper |

| Orrick | Faraaz Samadi | Millbank |

| Orrick | Keilly Blair | PWC |

| Orrick | James Lloyd | PWC |

| Norton Rose Fullbright | Paul Joseph | RPC |

| Addleshaw Goddard | Dr. Nathalie Moreno | Lewis Silken |

| Clyde & Co | Ian Birdsey | Pinsent Masons |

2019

| Acquiring Firm | Partner | Hired From |

| Kemp / Deloitte | Marta Dunphy-Moriel | Fieldfisher |

| TLT | Gareth Oldale | Sharpe Pritchard |

| Rosenblatt | Anthony Lee | DMH Stallard |

| Bevan Britten | James Cassidy | Moorfields (Inhouse) |

| DWF | JP Buckley | Shoosmiths |

2018

| Acquiring Firm | Partner | Hired From |

| Bristows LLP | Marc Dautlich | PM |

| Ashfords | Sarah Williamson | Boyes Turner |

| Fox & Partners | Ivor Adair | Slater & Gordon |

| Eversheds Sutherland | Simon Morrissey | Lewis Silken |

| Irwin Mitchell | Winston Green | Sainsbury’s Bank |

| Harbottle & Lewis | Sacha Wilson | Bristows |

| Paul Hastings | Sarah Pearce | Cooley |

| Reed Smith | Howard Womersley Smith | Taylor Vintners |

| Hogan Lovells International | Nicola Fulford | Kemp Little / Deloitte |

2017

| Acquiring Firm | Partner | Hired From |

| Bristows LLP | Robert Bond | Charles Russell Speechly’s |

| Farrer & Co | Ian De Freitas | BCLP |

| BCLP | Kate Brimstead | Reed Smith |

| MWE | Ashley Winton | White & Case |

| Charles Russell Speechlys LLP | Jonathan McDonald | Travers Smith |

| Reynolds Porter Chamberlain | Jon Bartley | Pennington Manches |

| Bird & Bird | Guadalupe Samepedro | Paypal |

| Kemp little / Deloitte | Anita Bapat | Hunton |

2016

| Acquiring Firm | Partner | Hired From |

| Rose Fulbright | Lara White | RPC |

| DLA Piper | Ross Mckean | Olswang |

| Allen & Overy | David Smith | ICO |

2015

| Acquiring Firm | Partner | Hired From |

| Bird & Bird LLP | James Mullock | Osborne clarke |

| White & Case LLP | Tim Hickman | Hunton |

| Wedlake Bell | James Castro-Edwards | PWC |

| Baker & Mckenzie | Dyann Heward-Mills | GE Capital |

Diversity and Inclusion

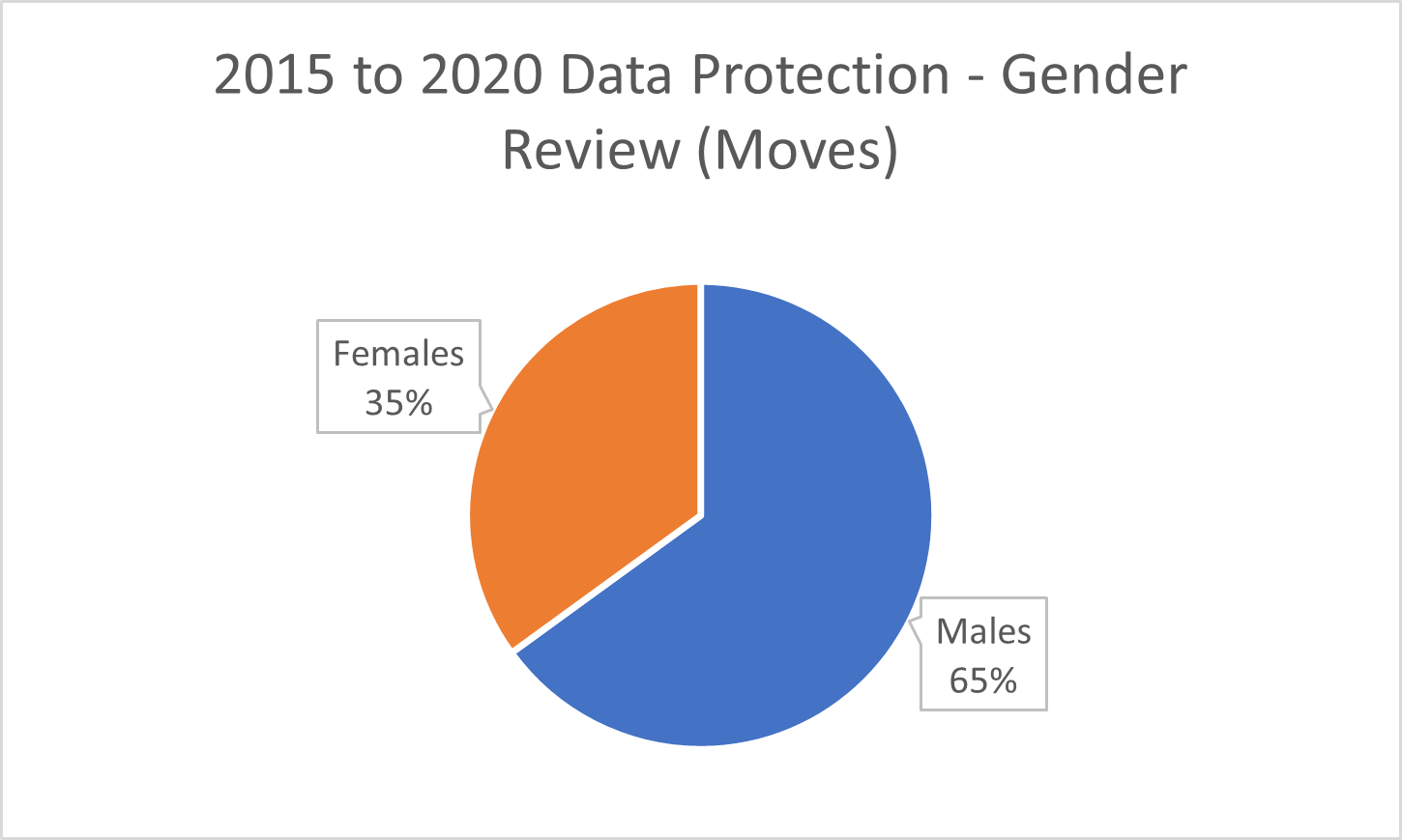

Below see the comparison between Male v Female partners on a year by year basis.

According to the SRA, women make up 50% of firms with 50 plus partners, which is higher than the 47% of the UK women workforce. However, the problem becomes apparent when we look at seniority statistics as women partners make up only 29% of firms with 50 plus partners. What is positive to see from the below chart is that the moves in the data protection space show 35% are female Partners, which shows that whilst there is a way to go it is the correct side of the 30% line.

Internally we have revamped our internal D&I policy to better promote the equality of women and ethnic minorities. While this will increase equality, the benefits of diversity and inclusion are well documented:

- “For every 10 per cent improvement in gender diversity, you’d see a 2-4 per cent increase in profits.”

- “Diversity means more debate and more perspectives and so better decisions,”

- “That leads to better business practices, more innovation, and improved risk taking.”

- A think tank found that 48 per cent of companies in the US with more diversity at senior management level improved their market share the previous year, while only 33 per cent companies with less diverse management reported similar growth.

Source click here

Conclusion

Data protection as a practice area continues to be stimulated by regulatory change and commercial pressures. Schrems 1, Schrems 2 and Brexit are all playing a role in increasing the need for advice, transactions, and dispute resolution within data protection.

The trend clearly indicates the demand for data protection lawyers increased in the run up to 2018. Following which less activity less activity in US law firms resulted in a tailing off in 2019. There is now a clear upswing in demand. 2020 highlighted that the market is growing again and that US international firms are acquiring significant practitioners. This will continue to grow as class actions become more frequent, lets face it the breaches are not slowing down and there will be increased opportunities to litigate.

Law firms may look to add to their transactional and disputes offering. 2021 is off to a quick start with all signs pointing to a similar if not a higher number of partner moved. It is likely that US firms will be a key driver of market moves as US data protection and cyber security practices will aim to connect London with their European practices.

Mathew is a Consultant at Fides Search. He dedicates his time to working with clients on their key strategic hires within TMT and the Data Protection & Cyber security market. To find out more get in touch with Mathew:

Mobile: +44 (0) 7391 405 563 | Direct Dial:+44 (0) 20 3642 1874 | mathew@fidessearch.com