Hello and welcome to the Brexit special of the Fides Weekly Update.

Results of the EU referendum have been released and as we face the decision that Britain have chosen to leave the European Union, we provide you with a short overview of the reactions in both the UK and European markets.

Tweet us @Fides_Search for your thoughts on the result #EURefResults

This week:

Brexit: Continental Shockwaves

Whilst an equally divided Britain wakes up to the news that the country will be leaving the European Union, the shock and in some quarters disbelief across mainland Europe might be more palpable. During recent weeks the team at Fides have been meeting and speaking with numerous leading figures across the continent to gather their views in the lead up to yesterday’s referendum. As those views in light of this morning’s news are outdated, we will provide a more extensive update next week once the dust settles across the EU, although the expectation across Europe from the legal and financial sectors prior to the result are important when assessing how these markets will evolve and move forwards in light of Brexit.

Generally speaking, most in mainland Europe held the view that there was a very limited chance for a Brexit, with some respondents almost dismissing the idea entirely contending that when the public went to the polls, Europe would prevail and the threat offered by the Leave campaign would be quashed. What we have instead is the complete opposite. Whilst here in the UK there was an awareness of a potential Brexit and a noticeable surge in momentum building from the Leave campaign, the European view seemed one of scepticism that this could actually happen. This scepticism has led to disbelief and dismay is now very much the reality. Whilst the UK comes to terms with this definitive change in course, the question that many within mainland Europe will now have to tackle is where this leaves their nations domestically from a political context, as the continued rise in nationalism is likely to surge upon this result.

Whilst the economy comes to terms with this result, we must recognise that the shock being felt across mainland Europe might potentially be greater than that seen here in the UK. Those in mainland Europe will now be coming to terms with the fact that there might be greater changes ahead for the EU, as the public voices of other member states might begin to be heard more loudly and clearly seemingly than those here in the UK.

We here at Fides remain committed to our work for clients across Europe and will bring full reaction to this result from our network next Friday.

Brexit: Market Reaction

Today Britain voted to leave the European Union. Law makers have been divided on the subject in spite of every major party aside from UKIP campaigning to Remain. It is now clear that London voted wholly in favour of the UK remaining in the EU, along with Scotland and Northern Ireland. Questions will now be asked and we will enter what must be considered a period of significant uncertainty. The reaction of the financial markets has been negative as expected, further exacerbated by the significant late betting on a remain vote last night worsening the fall of the FTSE and the Sterling.

Internationally, our close friends, colleagues and business partners will also be scratching their heads, no doubt asking themselves what next? The reality is that Brexit will create an unprecedented amount of work for law firms, but whether this is additive to the wider industry and how it effects the future of the sector is yet to be seen. Markets across the world are reeling from the ‘out’ vote and it is for our politicians and business leaders to provide calm heads and clarity to enable the financial markets to settle more swiftly from this shock. The Prime Ministers decision not to immediately invoke Article 50 following the result, along with statement from Bank of England governor Mark Carney, have offered the markets some comfort in the short term but the long term uncertainties will continue to create a fragile state within the City.

Importantly, whilst financial institutions and corporates will be looking for answers, we have seen law firms rally and react at pace to the questions of what next by utilising webinars to host briefings and setting up Brexit hotlines for clients. We anticipate that this trend will continue as there is a significant responsibility burdened on the legal sector to help clients understand and approach this period of change. Law firms along with many businesses will now have to consider their strategy here in the UK and across the continent in this newest of new worlds.

There is no doubt that challenges lie ahead for the legal sector, but given the calibre of lawyers based in London and their colleagues across Europe, we are sure that this will represent a truly interesting chapter in peoples career. The same has to be said for our friends and colleagues working in-house within legal and compliance. Those we canvased last night were somewhat more positive than those that we have spoken to this morning, but there is a sense of rallying to work through the shock to enable the UK and Europe to get through this as smoothly as possible.

So whilst this is a shock and goes against what many in the City might have wish for, it is those within the legal and compliance sectors that must react with a positive mindset to embrace this challenge, and we believe the industry and our clients are well placed to do so.

Movers & Shakers of the week

Moves

McDermotts makes double partner hire in London

McDermott Will & Emery have added Simon Goldring and Michael Holter to their partnership in London, sitting in their private client practice and transactional practice, respectively.

Dentons strengthen London corporate practice

Partner Jonathan Cantor is to join Dentons’ corporate practice in London from Nabarro

EY Legal boosts capability in the Americas

EY launches a legal services practice in Argentina with the hire Jorge Garnier from energy company Genneia as well as launching a practice in Chile with the former GC of retailer Falabella Paola Bruzzone. EY has also hired corporate partner Tony Kramreither from Norton Rose Fulbright to lead the legal team in Canada.

Freshfields senior corporate lawyer moves in-house

Mark Rawlinson, former head of corporate at Freshfields Bruckhaus Deringer, has moved to Morgan Stanley where he will lead their UK investment banking arm

Freshfields lose executive partner in NY

Executive partner Michael Lacovara joins Latham & Watkins in their litigation and trial department in New York

Reed Smith makes US securities appointment

Reed Smith has hired US securities partner Daniel Winterfeldt from CMS Cameron McKenna, where he previously led their international capital markets group

Office Openings & Closings

Mayer Brown launches first Middle East office

Mayer Brown has opened a new office in Dubai, to be headed up by Middle East chair Charles Hallab and regional corporate head Tom Thraya who both joined the firm from Baker & McKenzie last year.

Ashurst to close in Sweden

Ashurst is closing it’s Stockholm office, with all lawyers moving to local firm Hamilton

Mergers & Alliances

Ashurst partners with Axiom

Ashurst have announced a partnership with Axiom to support banks in meeting new regulations coming into force in 2017

Fieldfisher merges in Italy

Fieldfisher has merged with Italian firm Studio Associato Servizi Professionali Integrati (SASPI)

Partner Promotions

King & Wood Mallesons promotes 12 lawyers in Australia

Welcome back to the Fides Weekly Update. Here we provide you with the main trends, moves and developments in legal and compliance. Scroll down to check out the Movers & Shakers of the Week.

Tweet us at @Fides_Search – we would love to hear from you!

This week:

New tech on the market for OTC derivatives regulation

This week we saw an alliance formed between a magic circle firm and one of the Big Four that could signal a significant shift in the legal market.

Allen & Overy has partnered with Deloitte in developing a tech system that helps banks handle new regulatory requirements in the over-the-counter (OTC) derivatives market.

MarginMatrix is their newly launched digital derivatives compliance system, which codifies the laws in various jurisdictions and automates the drafting of tailored documents for OTC derivatives products, subject to rules under the European Market Infrastructure Regulation (EMIR).

The product also accommodates for the new margin requirements within EMIR coming into force this September. The new rules demand that all counterparties to derivatives contracts, which are not cleared through an authorised clearing system, must provide additional margin for their net exposures. Studies have estimated that banks will need to reserve approximately $10 billion to cover these initial margins. A&O claims that their new system will lead to significant cost-savings for their clients through the auto-drafting of complex documentation as well as minimise the risk of a non-compliant outcome.

The launch of this product was a ground-breaking move in the legal market, as it saw A&O and Deloitte join forces, combining A&O’s well-established derivatives practice with Deloitte’s impressive technical expertise and managed services. It highlights the impact alternative business structures are having on the legal market as they not only inject a new wave of competition in the sector, but also make strategic alliances to further solidify their stance in the sector.

MarginMatrix is just the latest in a string of new technology solutions tools available to law firm clients. Pinsent Masons’ Cerico, Simmons & Simmons’ navigator and A&O’s Rulefinder are some of the other tools banks can use to assist in maintaining regulatory compliance.

The Deloitte A&O tie-up is a further development that points towards the determination of professional services firms in becoming recognised legal services providers. It also adds to the raft of legal tech entering the UK legal market. With the increasing focus on effective client solutions, technology and innovation has become more fundamental in shaping law firms strategies, and we expect to see further developments both through increased outputs from law firm innovation labs and market collaboration.

Movers & Shakers of the week

Appointments

Sullivan & Cromwell elects new London managing partner

Corporate partner Richard Pollack has been named managing partner for the London office of Sullivan & Cromwell, taking over from Richard Morrissey in July

Moves

Simmons boost internal capital markets offering

Simmons & Simmons have appointed former Allen & Overy counsel Jeroen Bos to their international capital markets practice in Amsterdam as a partner

Jupiter Asset Management gains new GC

Former Man Group general counsel Jasveer Singh takes on new position as GC for Jupiter Asset Management

W&C appoint Asia corporate head

Linklaters former Asia head of private equity Chris Kelly has joined White & Case, where he will sit in their global M&A practice and lead their corporate practice in Asia

Debevoise associate becomes legal chief at investment manager

Chris Wright has left Debevoise & Plimpton to join Leadenhall Capital Partners as their head of legal

Skadden adds to white collar crime team in London

Partner Elizabeth Robertson leaves K&L Gates to join Skadden, Arps, Slate, Meagher & Flom in their European Government Enforcement and White Collar Crime practice

Quinn Emanuel hires HSF partner to launch UK construction disputes offering

Partner James Bremen leaves Herbert Smith Freehills to set up Quinn Emanuel Urquhart & Sullivan’s UK construction disputes practice

Paul Hastings hires A&O finance counsel

James Taylor has joined Paul Hastings as a partner in their City finance practice, moving from Allen & Overy where he was counsel in London and Frankfurt

Mayer Brown further expand private equity offering in London

James West departs Reed Smith to become a partner in Mayer Brown’s corporate & securities practice in London

Mergers & Alliances

Bond Dickinson makes transatlantic alliance

Bond Dickinson has carried out an exclusive strategic alliance with US firm Womble Carlyle Sandridge & Rice

Hello and welcome to the Fides Weekly Update. Take a look at this week’s key trends, moves and developments in legal and compliance.

Tweet us @Fides_Search to let us know your thoughts.

This week:

1) SFO TO CONSIDER REVISED FUNDING MODEL

Legal Business provided further insight this week on the Serious Fraud Office’s (SFO) investigation into the forex scandal. After having submitted a Freedom of Information request, the legal press site revealed the SFO totalled £2.1m spend whilst investigating the market rigging.

The FX probe was dropped in March this year as the fraud agency claimed “insufficient evidence” as to why they were unable to demonstrate criminal activity, leading to zero charges being made against banks or individuals.

It seems the SFO’s tactic of employing a blockbuster funding model, whereby supplementary funding for certain investigations is granted by the treasury, has been called into question. A report from HM Crown Prosecution Service Inspectorate has argued that relocating resources away from such high-profile cases could be “more effective and provide better value for money”. Although this funding has allowed the SFO to take on cases that would normally be too big to pursue, the report insists that more needs to be done to increase transparency and better define the SFO’s approach to their spending. During the forex investigation, the SFO requested an extra £21m in funding to help it keep pursuing complex cases, which equates to 60% of their total budget for major cases.

The failure to make convictions in this case has led to many losing confidence in the SFO’s appetite for large-scale investigations. More recently, the SFO have been working on plans to charge four Deutsche Bank employees and one SocGen trader in relation to the alleged manipulation of Euribor. Perhaps the outcome of this investigation will be the deciding factor in proving whether or not the organisation is in fact ‘fit for purpose’.

Supplying sufficient budget to equip the SFO with enough resource to tackle large cases such as market rigging will always be a disputable topic. The improvements made to the organisational culture and risk assessment at the SFO have been promising, but moving away from the blockbuster funding model may prove challenging as financial flexibility is necessary due to the lengthy and costly nature of their investigations.

2) US ASSOCIATE PAY

Following our analysis last week of associate salary increases in the Magic Circle, the war for top legal talent has intensified across the Atlantic following Monday’s announcement that Cravath, Swaine & Moore are raising base salaries for associates in New York and London to $180,000 (£123,600) for first-year lawyers.

In the first salary hike for junior lawyers since January 2007, before the financial crisis, the raise represents a $20,000 (£14,000) increase for first-year associates, which rises to $315,000 (£216,000) for eighth-year associates. This is up $35,000 (£25,000) on current levels at the firm, and is exclusive of any bonuses.

Associate Salary Scale – Cravath, Swaine & Moore

1st year – $180,000 ($160,000 + $20,000)

2nd year – $190,000 ($170,000 + $20,000)

3rd year – $210,000 ($185,000 +$25,000)

4th year – $235,000 ($210,000 +$25,000)

5th year – $260,000 ($230,000 + $30,000)

6th year – $280,000 ($250,000 + $30,000)

7th year – $300,000 ($265,000 + $35,000)

8th year – $315,000 ($280,000 + $35,000)

Response from the market has been sharp, with other predominant US law firms quick to confirm that they will match Cravath’s pay hike, with lawyers in London also set to benefit from the increase.

Milbank, Tweed, Hadley & McCloy, Paul Weiss Rifkind Wharton & Garrison, Weil Gotshal & Manges and Cahill Gordon & Reindel were among the first to agree to match Cravath’s pay levels, with Paul Weiss and Cahill both extending the rises to their London offices.

Wednesday saw the announcement that associates at Cooley, Debevoise & Plimpton, Simpson Thacher & Bartlett, and Skadden Arps Slate Meagher & Flom, will also receive pay increases on the scale adopted by Cravath.

Kirkland & Ellis have also agreed to match Cravath’s new pay scale in all of its offices up to those that qualified in 2010, who will receive $280,000.

Meanwhile, Latham & Watkins have also raised base pay for associates in a number of its international offices – including London.

According to The American Lawyer, Sullivan & Cromwell, Quinn Emanuel Urquhart Oliver & Hedges and Vinson & Elkins have all also upped their associate pay, although it is not yet clear whether these pay increases at these firms will apply to their offices outside of the US.

Cravath’s move to increase associate base salary in New York has also prompted UK firms in the region to review their associate compensation. Yesterday, Freshfields announced that first-year and second year associates in its New York and Washington offices will receive $180,000 a year, matching the increase by Cravath, whilst those who joined in 2007 or later will receive $325,000.

Clifford Chance has also announced this morning that US associates will also now receive $180,000, rising to $315,000 (£218,000) for those who qualified in 2008.

It is not surprising that leading law firms in New York and London have rushed to adopt Cravath’s new pay scale, which signals increased competition for a shrinking pool of top law graduates.

According to a report earlier this year in the American Bar Association, law schools graduated 39,984 students in 2015, down nine percent from the previous year. Beyond this, much of the drop-off has been among students with high GPAs and LSAT scores so firms have to be more aggressive to attract the best talent that is available.

For those in the AM 100 where it will not be feasible to adopt Cravath’s associate pay scale, it will be interesting to see how firms choose to implement the $180,000 starting salary across different ranks or office locations – as already witnessed at Kirkland and Latham’s – in efforts to remain competitive.

Cravath’s short partnership track of 8PQE also brings into question whether other law firms will do things differently on base compensation for their very senior associates and counsel. For the firms that only selectively introduce this model, salary compression and smaller pay increases for very senior associates is likely to be rife, erode associate morale and make it harder to retain lawyers at this level who are increasingly leaving for smaller firms or government and in-house opportunities.

In a broader sense, the raise in associate pay to $180,000 undercuts market trends to reduce the pricing of legal services and raises the question of how Cravath and others will meet be able to meet the needs of in-house counsel with limited budgets whilst their clients can obtain equal or better legal services at a fraction of the cost.

It also raises the question if such an increase in associate pay is needed to ensure the long-term growth strategy of UK-based international firms in the US.

MOVERS & SHAKERS OF THE WEEK

APPOINTMENTS

ISDA appoints new GC

David Geen has stepped down as general counsel for the International Swaps and Derivatives Association (ISDA), and is replaced by acting GC Katherine Tew Darras

Baker & McKenzie appoints new Chairman of the Firm

London managing partner Paul Rawlinson has been announced as the firm’s next global chair and is due to take over the role in October this year

WFW shifts chair to NY

Watson Farley & Williams moves chair Frank Dunne from its London to New York office and hires Mischon de Reya’s New York litigation head Joshua Sohn in an attempt to boost capability in New York

MOVES

EY expands competition team

Addleshaw Goddard’s competition head Phil McDonnell has joined EY as an executive director and head of competition law for the UK and Ireland

Eversheds adds to London financial services practice

Clifford Chance corporate insurance partner Hugo Laing has moved to Eversheds’ London office in their financial services group

Dentons launches Milan competition offering

Dentons has hired Michele Carpagnano from Gianni, Origoni, Grippo, Cappelli & Partners to launch a competition and antitrust practice in the Milan office

Osborne Clarke hires real estate duo

Real estate partners Jo Footitt and Louise Cartwright bot exit Irwin Mitchell to become partners at Osborne Clarke

Lathams adds Dechert finance expert to partnership

Jeremy Trinder has joined Latham & Watkins’ City finance practice from Dechert

White & Case makes finance push with Freshfields hire

Real estate finance partner Jeffrey Rubinoff has left Freshfields Bruckhaus Deringer to join White & Case

PwC Legal strengthen Australian offering

Four new partners have been added to PwC Legal’s partnership in Australia. Partners include Baker & McKenzie’s Ashley Poke and Ashurst’s Tiffany Barton into the corporate practice; Gilbert + Tolbin’s Cameron Whitfield as the head of PwC’s Australian digital and technology law practice, and Corrs Chambers Westgarth private equity partner James Delesclefs.

PARTNER PROMOTIONS

PwC Legal promotes five to director

Hello and welcome to the Fides Weekly Update. Take a look at this week’s key trends, moves and developments in legal and compliance.

Tweet us @Fides_Search to let us know your thoughts.

This week:

1. War for Talent: NQ Salaries on the rise

The war for talent further intensified this week as Clifford Chance became the fourth Magic Circle firm to unveil associate salaries for 2016-17.

The firm increased maximum pay by £1,000 for newly qualified (NQ) associates, hiking base salary to £85,000 plus a fixed bonus if individual development goals are met. This matches the NQ base salary at Freshfields, and offers more than the average pay and bonus for NQ lawyers at Linklaters.

As well as a salary uptick for associates with one year’s post-qualification experience (PQE) – from £90,600 last year to £95,000 – the firm also introduced changes to the base salary and variable bonus for 2 and 3 PQE solicitors depending on their contribution to the firm. Mirroring changes implemented in senior associate pay at Slaughter and May in 2013, those making a ‘good contribution’ can expect to earn a combined base salary and bonus of £100,000 at 2PQE and £111,000 at 3PQE, whilst those making an ‘excellent contribution’ are set to receive an average pay rate of £119,000 and £130,000.

Table: Magic Circle Associate Pay, 2016-17

| Firm | Conditions | Trainee | NQ | 1 PQE | 2 PQE | 3PQE |

| Clifford Chance | Base Salary | £43,500 (Y1)

£49,000 (Y2) |

£85,000 (+fixed bonus) | £95,000 | £100,000 (Good)

£119,000 (Excellent) |

£111,000 (Good)

£130,000 (Excellent) |

| Freshfields Bruckhaus Deringer | Base Salary | £43,000 (Y1)

£48,000 (Y2) |

£85,000 – £97,500 | £85,000 – £97,500 | £105,000 – £115,000 | £105,000 – £115,000 |

| Slaughter and May | Base Salary | £42,500

(Y1) £47,500 (Y2) |

£71,000 | £79,000 | £90,250 | £99,750 |

| Linklaters

|

Base Salary + Median bonus | £42,000

(Y1) £47,000 (Y2) |

£81,000

(£91,000) |

£90,000

(£101,000) |

£100,000 (£119,000) | £111,000

(£130,000) |

Despite this, Freshfields still offer the highest base salary for NQ associates as it announced a 26% uplift on NQ salaries this year from £67,500 to £85,000. Newly qualified and 1PQE associates sitting in the firm’s career milestone foundation (CMF) band can expect to receive a base salary of between £85,000 and £97,500, but will not be eligible for a bonus. Lawyers at 2 and 3 PQE, who also saw their salaries rise substantially to between £105,000 and £115,000 up from £87,500 to £100,000, are eligible to receive a bonus of up to 20%.This rise in associate salaries follows a firm-wide freeze in salary bandings last year.

This was accompanied by a more modest increase announced in base salary at Slaughter and May, with NQs receiving a pay rise of 2% to £71,500 and 1PQE lawyers receiving a 4.6% salary hike to £79,000. Linklaters on the other hand announced that a basic salary combined with median bonus for average NQ lawyers and 1PQE associates will stand at £81,000 and £90,000, although high performers can expect to take up to £91,000 and £101,000 respectively.

Pressure on the magic circle to increase NQ pay and capture upcoming talent comes from competition by US firms in London. In April, Sidley Austin increased the salary of all London associates to at least £100,000 to match Kirkland & Ellis’ London rates after acquiring a team of six partners and 14 associates from the firm. In December, Vinson & Elkins became the latest firm to join the ‘100 club’ as it boosted NQ pay by 25% from £80,000 to £100,000. Other firms offering these levels of associate pay include Sullivan & Cromwell (NQ salary: £101.5k), Latham & Watkins (£101k), Akin Gump (£100k), Davis Polk (£100k) and Weil Gotshal & Manges (£100k).

Whilst it is clear associate salaries are on the rise across the City, only time will tell if the Magic Circle and other UK firms can balance their bandings to repel the continuing US encroachment into the London legal market.

2. A glance into the Swiss legal market

Attention has turned to the Swiss legal market over the last few weeks as it was reported Quinn Emanuel and Charles Russell Speechlys have both made advancements in this market. With Quinn Emanuel opening an office in Zurich and Charles Russell Speechlys making three partner hires in Geneva, is the Swiss market gaining global law firm interest?

Quinn Emanuel announced last week they have opened their eighth European office in Zurich by relocating London-based white-collar and corporate investigations partner Thomas Werlen, making them the second US firm to launch a Swiss legal offering this month after Curtis Mallet-Prevost Colt & Mosle opened in Geneva. Additionally, Charles Russell Speechlys made three hires in Switzerland with corporate partner Olivier Cavadini from Python & Peter as well as criminal law partner Bruno Ledrappier and family law partner Grégoire Uldry, both joining from Borel & Barbey.

International firms don’t have much of a presence in Switzerland as they do in other European jurisdictions. The only solid international offering comes from Baker & McKenzie, who are highly regarded across a number of practice areas, whilst CMS, Eversheds and Sidley Austin are also noted for certain capabilities. This in turn suggests that movement is minimal, but areas with the highest number of lateral moves are corporate/M&A and litigation. Eversheds in particular have enhanced their Swiss offering over the last year, hiring corporate partners Daniel Bachmann, Gerald Brei and Urs Reinwald from EY, Homburger and Lenz & Staehelin respectively. White & Case also made a high-profile Swiss hire last September when Anne Véronique Schlaepfer joined the firm as their first Swiss arbitration partner. She joined from leading Swiss firm Schellenberg Wittmer, where she served as their co-head of arbitration.

The gradual influx of international law firm activity could be attributed to their changing banking landscape. With increasing transparency in Swiss banking law, the market is witnessing a rise in the number of cross-border deals, whilst the changes being made to Basel III regulation has also brought about a steady increase in regulatory and compliance work. Although this has made the market more attractive and opened it up to international players, it still holds a number of barriers to entry. A key hurdle for international firms is gaining a strong client base. Newcomers to the Swiss market find it difficult to gain reasonable market share, as clients are focused on maintaining long-term trusted relationships already built with domestic firms.

Since a new unified code of civil procedure was introduced in Switzerland in 2011, which led to all 26 divisions in Switzerland operating under the same civil procedural law, it has provided foreign law firms with an incentive to set up in the region and further extend their multi-jurisdictional presence. The Swiss legal market has indeed proved to be a slow burner, but the potential for business is evident, and levels of activity and sizeable deals continue to become more prominent. It is therefore likely that we will see continued advances from international firms in this small but not insignificant market.

Movers & Shakers of the Week

Appointments

Ashurst makes a number appointments as part of new management structure

Simon Beddow has been named Ashurst’s first London managing partner, whilst other partners across the firm also joined the Ashurst’s management team

BAT choose new head of legal

Formerly head of regulatory and corporate affairs for Western Europe, Benoit Belhomme has been made British American Tobacco’s head of legal and external affairs as well as regional general counsel for Western Europe

Moves

Ashurst appoint a strategic director of corporate lending

Former lawyer Dave Rome has left RBS as their head of EMEA loan markets to become strategic director of corporate lending at Ashurst

Coca-Cola European Partners gain new GC

Clare Wardle picks up general counsel and company secretary role at Coca-Cola European Partners. She was previously group general counsel for Kingfisher

Deutsche lose legal chief and head of active asset management

Emma Slatter, global head of strategy for legal, and James Hooper, head of active asset management, have both left Deutsche Bank this week

Lathams gains leading arbitration partner from US rival

Latham & Watkins has hired arbitration partner Sophie Lamb from Debevoise & Plimpton to sit in their London disputes practice

Norton Rose take on Sidleys’ US public finance team

The whole US public finance team of Sidley Austin has moved to Norton Rose Fulbright, sitting in San Francisco, New York and Washington. the 17 lawyer team includes six partners: Larry Bauer, Matt Hughey, Peter Canzano, Jerry McGovern, Eric Tashman and Cliff Gerber.

Milbank partner joins one of the Big Four

Partner Laetitia Costa departs Milbank, Tweed, Hadley & McCloy to join PwC Legal as their head of banking & finance in the City

A&O adds to global IP practice

Marjan Noor has left Simmons & Simmons to join Allen & Overy as a patent disputes and regulatory partner

KWM loses German IP partner

IP and IT partner Manuela Finger departs King & Wood Mallesons’ Frankfurt office to join Gowling WLG in Munich

Hogan Lovells builds out Asia capital markets team

Hogan Lovells has added Paul Hastings’ Hong Kong office head Sammy Li and DLA Piper’s head of US capital markets Stephen Peepels to their Hong Kong office

Hello and welcome to the Fides Weekly Update. Take a look at this week’s key trends, moves and developments in legal and compliance.

We are delighted to announce the addition of Max Alfano to the team at Fides Search. Max has developed a great reputation with candidates and clients alike across the Buy Side and brings a wealth of knowledge and recruitment experience to the table. His skill set complements our strategy to be a leading search partner for our clients across financial services.

Max has developed experience working with clients across the spectrum of Legal and Compliance. He brings significant industry experience and an exceptional network. He has developed a reputation as a trusted advisor and fantastic recruitment consultant.

Fides Search saw an opportunity to tap into his knowledge of the buy-side to also support our work with law firms in both consultancy and search work.

‘It has become increasingly important to support clients across the spectrum of legal and compliance. We have also seen an increase in regulatory pressure which is impacting on the Buy side. Max is not only an exceptional addition to the team but he also has a fantastic track record in working with the Buy side and the financial services sector in general. We are delighted to welcome him to the team and look forward to introducing him in due course’. Ed Parker, Director

This week:

Regulation, Funds & Brexit: An Asset Management Commentary

The UK asset management market has seen the greatest number of outflows since the recession in January this year, with investors growing increasingly frustrated with volatile markets. The impending referendum with debating on a potential Brexit has only added to potential woes. Global Stocks dropped significantly with fears of China’s slowing economy & currency depreciations.

Seemingly, with ‘banker bashing’ becoming a subject of a bygone era, focus has turned towards the asset management industry, with the FCA continuing … Click here to read further

Movers & Shakers of the week

Appointments

Linklaters vote in new senior partner

Charlie Jacobs has been appointed senior partner at Linklaters, following Robert Elliot’s term in the position

Freshfields appoints three new sector heads

London partner Natasha Good is to become the new co-head of their TMT group, New York partner Valerie Ford Jacob will serve as co-head of the financial institutions group and Brussels partner Rafique Bachour has been appointed co-head of the general industries group

Moves

Weil Gotshal build London corporate practice

Corporate partner James MacArthur leave Herbert Smith Freehills to join Weil, Gotshal & Manges in London

DLA expand Middle East capabilities

DLA Piper has hired Ramsey Jurdi as a partner in their Litigation, Arbitration and Investigations team in the Middle East. Jurdi joins from Chadbourne & Parke’s Dubai office

Linklaters lose three London partners to Kirkland

Kirkland & Ellis has hired private equity partner Stuart Boyd, corporate partner David Holdsworth and private equity tax partner Tim Lowe, all from Linklaters’ London office

A&O strengthens tax practice

Allen & Overy hires Daniela Trötscher in its Frankfurt office as partner. She was previously a partner at Ernst & Young

Office Openings & Closings

Last of the Bingham McCutchen team to move into Akin Gump’s offices

The 21-partner team from former US law firm Bingham McCutchen has joined colleagues from Akin Gump Strauss Hauer & Feld in their offices at Bishops Square in London.

Quinn Emanuel open in Switzerland

Quin Emanuel has launched their eighth European office in Zurich

Clyde & Co open in Miami

Clyde & Co has opened a Miami office with a five partner litigation team from litigation firm Thornton Davis Fein

Partner Promotions

King & Wood Mallesons promote six in Europe, UK and Middle East, which includes three in London

Welcome back to the Fides Weekly Update. Scroll down to see what news stories our Researchers have been talking about this week in the world of legal and compliance – and don’t forget to take a look the Mover & Shakers of the week!

This week:

1) Relocation, relocation, relocation

Offshoring topped the headlines this week as Dentons, Norton Rose Fulbright and DLA Piper were the latest of a string of firms to announce the relocation of a number of support roles to lost-cost service centres across the globe.

DLA are making the largest relocation, as it announced last Friday that up to 200 jobs will be shifted from their UK business services team to their low-cost centre in Warsaw. Amounting to 18% of UK support staff, offices in Sheffield and Leeds are most likely to bear the brunt in this latest round of consultations, with 85 jobs at risk in the firm’s Yorkshire offices and 47 jobs at risk in London.

Dentons also announced that they planned to open a business services centre in Warsaw this week, with the relocation of 50 roles that represents 12% of Dentons UK-based business staff. Dentons Business Services EMEA plans to have 90-100 staff by the end of the year, and is to be directed by Piotr Macieja who joined from global professional services provider TMF.

On the other hand, Norton Rose Fulbright have selected Manila as the destination for their low-cost service centre, revealing that they are opening in The Philippines in September. Aiming to relocate 170 roles – 5% of the firm’s support office jobs globally – 59 jobs have been put at risk in the UK, which equates to 10% of the firm’s London support staff.

Other UK firms to create back office support centres include Freshfields Bruckhaus Deringer, which opened a support centre in Manchester and is aiming to launch a second in Vancouver; Herbert Smith Freehills and Allen & Overy, which both opened support centres in Belfast; and Linklaters, who also have business support functions in Warsaw.

Motivation for law firms to relocate back-office functions outside of the UK goes beyond simple cost cutting measures to further consider how support for lawyers can be made as effective and efficient as possible. For example, the current consultation underway at DLA Piper is part of a global review that started two years ago with advice from McKinsey & Company as to how the firm could operate more effectively on a global basis.

These latest offshoring announcements indicate that law firms continue to cut costs in attempt to drive future profitability. However, to ensure that the quality of support for lawyers (and clients) remains paramount, law firms should also look to innovate and automate some of their support functions for the future.

2) Legal team shake-up

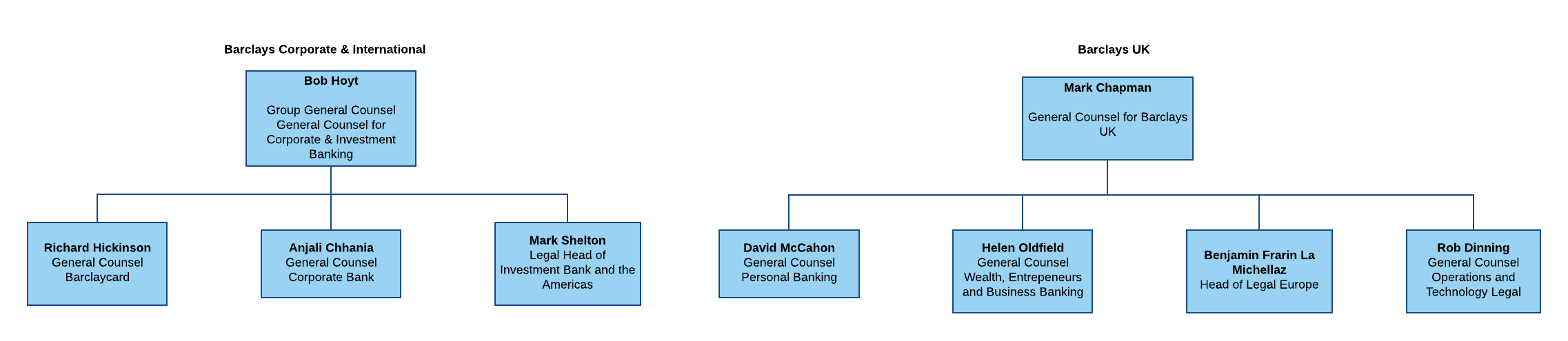

The looming reforms on ring-fencing have brought about a significant restructuring of Barclays’ legal team this week. The bank’s new structure will comprise of two core divisions, Barclays Corporate & International and Barclays UK, with the legal team split to be positioned in either of the two banking arms. On account of the restructuring, senior management for the two legal teams will look as follows:

The Prudential Regulation Authority produced its final policy on implementing ring-fencing regulations in March, which demands all UK banks’ retail arms are separated from the rest of the business and, in particular, away from their investment banking activities. This should in turn protect customers by reducing their exposure to the bank’s high-risk investment banking operations.

Barclays are the first of their competitors to report a legal restructuring on the back of ring-fencing, whilst Lloyds Banking Group made a legal appointment, overseeing their ring-fencing process. Former Berwin Leighton Paisner corporate partner Frances McLeman initially joined Lloyds as their interim head of corporate and M&A legal. She was appointed head of ring-fencing legal in January this year, where she leads their group restructuring plans and banking regulatory reform in relation to ring-fencing.

Whilst Barclays restructure their team to cope with the demands of ring-fencing, Freshfields are also restructuring in an attempt to improve collaboration amongst partners. Individual team practices within the firm’s finance practice will be consolidated to form three larger team practices, which should allow them to better service their clients by providing “more flexibility across the spectrum of debt products”.

Asset, project and aviation finance will form one group, capital markets and corporate treasury will also form another practice and their greenfield, brownfield and bond groups will merge into one infrastructure team.

We plan to see a number of further restructurings taking place, especially within the banking sector as many banks are yet to ring-fence operations. HSBC are expected to implement changes to their retail operations in 2018, which could see a large part of their legal team relocate to Birmingham where the new UK retail and commercial banking head office will be based.

Movers & Shakers of the week

Moves

Lloyd’s of London lose GC

General counsel Sean McGovern has left Lloyd’s of London to join insurance and reinsurance company XL Group as their chief compliance officer, head of regulatory and government affairs

Bird & Bird hire aviation finance expert

Jim Bell has joined Bird & Bird as a partner in their Aviation & Aerospace group in London. He leaves Allen & Overy, where he served as a senior associate in their Structured and Asset Finance group

White & Case add to growing City corporate practice

Hogan Lovells corporate partner Guy Potel has joined White & Case’s corporate practice in London

Proskauer strengthen their real estate offering in London

Joanne Owen, DLA Piper’s former global co-chair of hospitality and leisure, has moved to Proskauer Rose’s London office, where she serve in their real estate practice

Ashurst expand German corporate capability

Former Linklaters corporate partner Holger Ebersberger has joined Ashurst’s partnership and will sit in their Munich office

Pinsents add to Düsseldorf office

Dr. Anke Empting joins Pinsent Masons from KPMG Law in Düsseldorf as a partner to strengthen their energy and life sciences practices

Dentons boost ETI practice

Clyde & Co’s David Moore has moved to Dentons as a partner and will sit in their London Energy, Transport and Infrastructure (ETI) practice.

Office Openings & Closings

Ince & Co set up in Cologne

Ince & Co has hired CMS Hasche Sigle’s head of insurance Stefan Segger, along with two associates to launch their second German office in Cologne. They have also brought on partner Eva-Maria Goergen who joins from local firm Bach Langheid Dallmayr

Norton Rose move back office support to Manila

Norton Rose Fulbright plans to relocate 170 support jobs worldwide, including 60 in London, to a business services centre in Manila

Dentons also choose to set up shared services centre outside the UK

Dentons has announced a new low-cost business support facility in Warsaw, which will lead to the loss of approximately 50 UK roles

Partner Promotions

Travers Smith promotes six to partner

Hello and welcome to the Fides Weekly Update. Take a look at this week’s key trends, moves and developments in legal and compliance.

Tweet us @Fides_Search to let us know your thoughts.

This week:

1) US firms feast on London market

The domination of US firms within the London legal recruitment market was further confirmed this week with the publication of research by Legal Week, which found a 20% increase in lateral partner hires into US firms in 2015.

Last year US-based law firms made 110 lateral partner hires, up from 90 in 2014, making this the highest number of lateral partner hires to be made by this group in the last four years.

With the launch of its first European office in January, Cooley’s was the biggest lateral hire in the London market last year. The firm brought across 24 partners including teams from Edwards Wildman and Morrison and Foerster to open their London office whose headcount now stands at over 60 lawyers.

Other firms that were particularly active in the lateral recruitment market include Morgan Lewis, Ropes & Gray, King & Spalding, Kirkland & Ellis, Morrison & Forrester, Gibson Dunn & Crutcher and White & Case.

However, London expansion was not on the agenda for all US firms with Skadden, Arps, Slate, Meagher & Flom, Sidley Austin and Davis Polk seeing London partner numbers contract over the 12-month period.

In a year that saw high profile hires in the likes of Steve Thierbach to Gibson Dunn, Matthew Elliott to Kirkland & Ellis and David Ereira to Paul Hastings, is the aggressive lateral partner hiring strategy of US firms set to continue?

If the start of 2016 is anything to go by, the trend for US and international firms to boost their London offering looks here to stay.

Last week saw White & Case make a second lateral partner hire from Ashurst as part of their strategy to reach 500 lawyers in the City, and Kirkland & Ellis returning to familiar hunting ground Linklaters for partner hires in tax and private equity.

In April, Cleary Gottlieb Steen & Hamilton made only its third London lateral partner hire in more than a decade with the recruitment of Allen & Overy’s head of non-contentious financial services regulation Bob Penn.

However, the flow of lateral partner hires has been more than just one way with Kirkland losing seven London partners to Freshfields and Sidley’s in February which saw the firm double its notice period for equity partners.

The increase in lateral recruitment trends by US firms from 2015 and beyond show the scale and depth that many US firms have now achieved in the London market.

This will continue to pile pressure on UK firms as they scramble to protect their top talent, with the Magic Circle now looking to compete by reviewing the equity and remuneration structures they have in place to attract high profile partners – as evidenced by Freshfields hiring of Kirkland high-yield partner Ward McKimm.

However the impact of these lateral recruitment trends play out in the future, the one certainty is that for now at least, London is the place to be.

2) Anti-Corruption on top of the agenda

The ‘Panama Papers’ scandal brought about a flurry of protests after it led to the surfacing of multiple cases of corruption, money laundering and tax evasion. As world leaders begin damage control and attempt to deal with the corruption that has now come under the spotlight, the UK has decided to hold an Anti-Corruption Summit, hosted by Prime Minister David Cameron in London, in an attempt to face the global challenges for combating corruption.

Prior to the summit, a UK Country Statement was released, outlining three main objectives: to expose corruption in the UK; to introduce stronger legislation that punishes the corrupt and supports those affected, and to eliminate the culture of corruption.

It seems top executives are all on board with the statement as many have signed a pledge confirming their commitment to collectively crackdown on corruption, particularly in jurisdictions where regulatory frameworks are less developed. The executives involved include a number senior management from law firms, such as Ashurst, White & Case, Allen & Overy, Linklaters and Herbert Smith Freehills.

The firms have released a joint statement in which they profess to “play our part in efforts to prevent the proceeds of crime and corruption from entering legitimate capital and investment markets”.

Whilst law firms are tackling the issue by backing new government policy and regulation, banks are also making steps to improve their stance against anti-money laundering and financial secrecy by culling tens of thousands of existing customers.

The FT reported on Wednesday that Deutsche Bank, Barclays and UBS will be closing between 20,000 and 35,000 customer accounts. These accounts are found within their corporate and investment banking operations and have been deemed “too risky under anti-money laundering rules or…have become uneconomic in light of new regulations”.

The culling has proved worthwhile as plans were announced in the Anti-Corruption Summit that financial services companies are to be made liable for their employees’ complicity in money laundering and fraud. With the onus now on the financial services companies, it is likely we will see a similar overhaul of clients from further institutions.

Professional services firms and financial institutions all seem to be on board with the new measures, and the addition of corporate liability will provide a major incentive for them to improve their financial crime policies and procedures. However, it is difficult to maintain momentum when trying to create systemic change in the financial services industry. We saw similar issues with the FCA’s Senior Manager’s Regime, as it lost its sting when abandoning the “reverse burden of proof” clause, which would have held senior managers to account for compliance failings. Ultimately, time will tell as to whether the fight against corruption will succeed and if it remains a priority on the agendas of the world’s elite.

Movers and Shakers of the week

Appointments

Saudi Aramco appoints new GC ahead of their IPO

Nabeel Al Mansour has been named new general counsel at Saudi Arabia’s state owned oil company Saudi Aramco, after previously serving as deputy general counsel.

Moves

BLP lose head of international arbitration

Kent Phillips has left Berwin Leighton Paisner to join Hogan Lovells in their Singapore office. Jonathan Sacher will replace Phillips as head of international arbitration in London

Sidley enhances London employment practice

Susan Fanning has joined Sidley Austin from DLA Piper and will sit in their labor, employment and immigration practice

Mayer Brown gain energy lawyer in Paris

Olivier Mélédo departs Orrick, Herrington & Sutcliffe to join Mayer Brown in their Banking & Finance practice and Energy group

K&L Gates strengthens energy practice in Milan

Former DLA Piper energy specialist Paolo Zamberletti joins K&L Gates in Milan. He is the fourth addition to the firm’s global energy practice in 2016.

Gowling WLG make double partner hire

Gowling WLG have hired banking and finance partner Matthew Harvey from Dentons and projects partner Andrew Newbery, who previously headed up Herbert Smith Freehills’ Abu Dhabi office, after which he set up his own consultancy in London.

Taylor Wessing bolster their TMC practice

Former Latham & Watkins global technology co-chair Martin Cotterill has made a move to Taylor Wessing, where he will sit in their technology, media and communications practice.

Norton Rose bolster European tax offering

Tax partner Antoine Colonna d’Istria is to join Norton Rose Fulbright from Freshfields Bruckhaus Deringer in Paris

Weil Gotshal gain HSF’s London head of PE

James McArthur, London head of private equity at Herbert Smith Freehills, has joined Weil, Gotshal & Manges in London

Fifth Ashurst partner to join Goodwin Procter in Frankfurt

Ashurst tax partner Heiko Penndorf will join Goodwin Procter’s Frankfurt office after the US firm launched their Frankfurt office with four Ashurst partners

Lathams gain antitrust partner in Germany

Leading antitrust lawyer Michael Esser has joined Latham & Watkins in Düsseldorf as a partner. He previously worked at Freshfields Bruckhaus Deringer’s Cologne office

Office Openings & Closings

DLA plan to axe 200 jobs in UK, focusing on Warsaw centre

DLA Piper consider cutting 200 business support roles in the UK and shifting the roles to their shared services hub in Warsaw.

Ex-CC partner launches boutique in Sydney

Mark Pistilli, former managing partner of Clifford Chance’s office, has set up a corporate boutique in Sydney alongside fellow partner Danny Simmons. The firm will be called Pistilli Simmons.

Dentons launch Munich office

Dentons are setting up their third German office in Munich with the hire of three partners from Norton Rose Fulbright. German head of corporate Alexander von Bergwelt, fellow corporate partner Michael Malterer and tax partner Igsaan Varachia will all be making the move.

Welcome back to the Fides Weekly Update. Here we provide you with the key news, trends and developments in legal and compliance. Scroll down to see the Movers & Shakers of the week.

Follow us @Fides_Search for regular market updates

This week:

1) Battle of the Brands

Wednesday saw the annual release of The Acritas UK Law Firm Brand Index, with Eversheds retaining the top spot for the third year running ahead of DLA Piper and Pinsent Masons.

The most comprehensive annual study of the global legal market, the Sharplegal survey canvasses over 2,400 senior buyers of legal services from across the globe to track how legal buyers select law firms and highlight those law firms winning, and losing, brand equity.

As such, the brand index works as a definitive guide as to which UK legal brands are strongest in the eyes of buyers. Rather than being a reflection of technical competence alone, it reveals which firms are prevalent in the client’s minds, whom they are most attracted to and whom they are most likely to give their work.

Eversheds continues to hold a strong position at the top of the UK brand index, being ranked by legal purchasers as first for mind awareness and favourability. This was particularly the case amongst female clients, with the firm’s ability to offer innovative pricing models having a greater appeal amongst this group. Second-place DLA was this year’s star performer, rising 22 points and 4 ranks on the index from last year and being used most by survey respondents for high value work.

Meanwhile, Slaughter and May came in as the second most improved firm, rising from 7th to 4th place on the brand index and overtaking Magic Circle rivals Clifford Chance (5th), Linklaters (6th) and Freshfields (7th). In fact, Slaughters are the only Magic Circle firm to hold a steady position in the UK market since the survey’s inception, with all other Magic Circle firms loosing brand equity nationally since 2012. Despite this, when the data is split down for London the brand index reveals a very Magic Circle dominated affair, with Clifford Chance ranked top followed by Freshfields and Slaughters.

With the average client working with 20 or more law firms at any given time – and marketed to by many more – the findings of the Acritas brand index are important in understanding what can give law firms a competitive advantage in a market that is fragmented, dynamic and constantly changing.

How the index changes over time is a reflection of which firms are doing a better job of making and maintaining a meaningful impression with clients through experience, relationship development and taking an approach to market that really aligns with clients’ goals and needs.

This year’s results show that firms that honestly assess their practice strengths and align themselves to specific client needs are more likely to be favoured by top UK legal clients. This shows that, like it or not, a cohesive and impressionable brand is an essential strategic tool for UK law firms to maintain their standing in the marketplace.

2) RSA on the Road to Recovery

Quarterly earnings have been coming in hard and fast this week, with HSBC, Shell and SocGen all releasing their financial results. RSA in particular shook up the markets, as their promising results caused a boost in the FTSE 100 Index of 0.3 per cent.

The insurance group beat analysts’ forecasts this year by reporting an operating profit of £548m, up 5 per cent from 2015, and a 2 per cent rise in UK and Irish sales, allowing a solid revenue of £1.57bn for the first quarter of the year.

Such a good start to the year can be attributed to the major internal restructuring, as RSA dispose of a number of overseas businesses, particularly those in Latin America, and reduce their presence from 47 countries down to 12. The company continues to implement it’s cost-cutting programme and has recently completed further sales of its Chile and Argentina businesses.

Concentrating on their most profitable businesses in the UK and Ireland, Canada and Scandinavia is paying off for the insurance company, highlighting their resilience after the abandoned £5.6bn takeover bid with Zurich Insurance last summer. Since then, their share prices are recovering and profits are ahead of expectations.

Chief executive Stephen Hester said RSA’s improvement comes down to changes made on a granular level, by improving their underwriting performance and core business units. He says businesses “have to stop relying on top line growth and instead become more efficient, much as manufacturers did in the 1970s and ’80s.”

Hester also spent £480,000 of his own money in acquiring company shares, a move that demonstrates his confidence in their self-improvement measures and new business model.

Despite rough markets, RSA have delivered encouraging results for the first quarter. However, it will difficult to assess the sustainability of this as cost-cutting cannot be a long-term strategy and insurance markets remain as competitive as ever. Nonetheless, analysts seem hopeful and earnings per share have been tipped to almost triple in 2017.

Movers & Shakers of the Week

Moves

Kirkland hire two further partners from Linklaters

Private equity partner David Holdsworth and tax partner Tim Lowe are the latest partners to join Kirkland & Ellis from Linklaters

General counsel Anja Van Bergen has left Nutreco to join Nomad Foods after the firm acquired €2.6bn company Iglo.

Reed Smith lose senior tech partner

Taylor Wessing has hired former Reed Smith partner Angus Finnegan as new head of the firm’s UK communications group

Lathams boosts competition team in Germany

Competition partner Michael Esser has joined Latham & Watkins’ Düsseldorf office from Freshfields Bruckhaus Deringer in Germany.

W&C hire second Ashurst partner in two weeks

White & Case have hired Ashurst’s London head of disputes Mark Clarke, only two weeks after bringing in former Ashurst equity capital markets partner Jonathan Parry.

HSF hires Bakers’ EMEA head of M&A

Senior corporate partner Sönke Becker joins Herbert Smill Freehills’ corporate team In Düsseldorf, exiting Baker & McKenzie, where his previous roles included chair of the firm’s EMEA M&A practice and prior to that, German corporate practice co-head until 2014

A&O add a three-strong US securities team in Australia

A US securities team from Skadden, Arps, Slate, Meagher & Flom joins Allen & Overy in Australia, after Skadden confirmed it was closing its Sydney offices. Partner Mark Leemen makes the move along with counsel Cécile Baume and associate Matthew Lim.

Osborne Clarke make first lateral hires in over a year

London partner Ashley Hurst is joining Osborne Clarke’s commercial and regulatory disputes team from Olswang, whilst Bristol partner Will Robertson departs Bond Dickinson to join Osborne Clarke’s commercial team, specialising in IT and data protection

Stephenson Harwood launches French real estate practice

Pierre Nicholas-Sanzey has been appointed partner at Stephenson Harwood in Paris to launch a dedicated Paris real estate department. He joins from the Paris office of Herbert Smith Freehills

WFW bolsters corporate offering in Frankfurt

Watson Farley Williams has hired Dr. Christoph Naumann as a partner. He joins from Norton Rose Fulbright where he served as Of Counsel.

Partner Promotions

DAC Beachcroft promotes 12 partners, two in the City

Kennedys promotes seven to partnership

Ashurst add 12 to partnership, 3 in London

Simmons makes up 7 to partner, including 3 in London

DLA Piper makes up 48 partners globally, with 8 in London

CMS makes up 31 partners, including 2 in London

Hello and welcome to the Fides Weekly Update, a breakdown of the week’s key news, moves and developments in legal and compliance.

This month’s blog explores the impact falling oil prices have had on global banks and the outlook this holds for the sector in the future.

Tweet us @Fides_Search to let us know your thoughts and feedback

Featured Blog: Has the broken energy market injured global banks?

As results for Q1 2016 are gradually released by the major global banks and financial institutions, there is one question we are all asking: how much have they been affected by depressed oil prices?

Oil prices have been on a downward spiral, and oil producers and lenders alike are desperately seeking for ways to lift the price… Click here to read further

MOVERS & SHAKERS OF THE WEEK

Moves

Cleary Gottlieb picks up A&O finance regulation head

Allen & Overy’s head of non-contentious financial services regulation Bob Penn joins Cleary Gottlieb Steen & Hamilton.

Barclays Competition Head to join Baker & McKenzie

Baker & McKenzie makes a second high-profile hire from Barclays with MD and Head of Competition Nicola Northway.

Sidley Austin bolsters private equity team with Willkie hire

Leveraged finance partner James Crooks joins Sidley Austin from Willkie Farr & Gallagher

Ashurst capital markets partner to depart for White & Case

Ashurst ECM partner Jonathan Parry makes the move to White & Case

Pinsent Masons picks up former TMT practice head at Simmons

Andrew McMillan, who led the TMT practice at Simmons until 2015 joins Pinsent Masons as a partner within its advanced manufacturing and technology sector (AMT)

Freshfields bolsters US offering with hire of leading Department of Justice white-collar prosecutor

Deputy Chief of the USDoJ’s criminal fraud section Daniel Braun joins Freshfields Bruckhaus Deringer.

Mergers

Reed Smith and Pepper Hamilton call off merger talks

Reed Smith calls off merger talks with Philadelphia-based Pepper Hamilton.

Partner Promotions

Norton Rose Fulbright make up 39 partners globally, with two four in the firm’s London office

CMS promotes 31 to partnership with five in the UK

Eversheds make up 26 partners globally, with four in the firm’s London office

Stephenson Harwood promotes nine to partnership with five in London

Charles Russell Speechlys promotes nine to partnership with six in London

HFW make up 9 partners globally, with three in the firm’s London office

RPC promotes three to partnership in latest round

Irwin Mitchell promotes 13 to partnership with three in London

Hello and welcome to the Fides Weekly Update. We’re here to bring you a breakdown of this week’s most interesting new stories in legal and compliance. Scroll down to see the Movers and Shakers of the week.

This week:

1) Partner Promotions Snapshot: The Story so Far

Promotion season is upon us, with a number of UK law firm’s announcing their latest rounds of promotions this week.

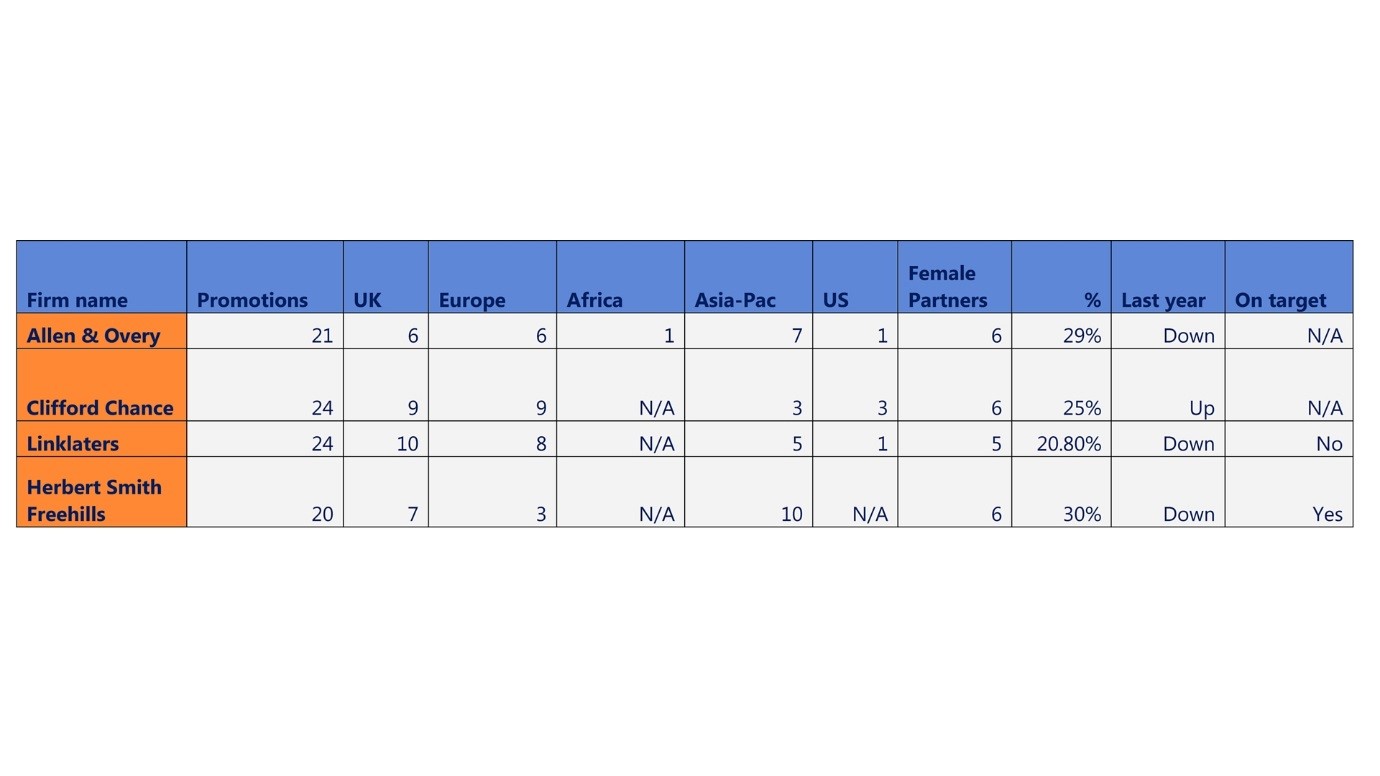

Of the Magic Circle, Clifford Chance and Linklaters announced global promotion rounds of 24, whilst Allen & Overy have made up 21 associates to partner. With 10 partners made up in the city, Linklaters saw the largest number of promotions in London, followed narrowly by Clifford Chance (9) and A&O (6). Whilst promotions were evenly distributed across the UK and EMEA with the former, A&O made up the majority of their partners in the Asia-Pacific in a predominantly banking-focused promotion round. On the other hand, Linklaters favoured its capital markets practice having not made any promotions in this space last year, whilst at Clifford Chance promotions were split evenly across corporate and finance.

The story was similar at global firm Herbert Smith Freehills who announced their latest round of promotions today. The firm made up 20 partners worldwide, including six in Australia and seven in London. Of this, eight were made up into corporate and five into finance. Focus on gender equality has not been far from these announcements, with Clifford Chance and A&O making up six female partners (25% and 29% respectfully) compared to Linklaters five. This was down on last year’s promotion round for A&O, who made up an impressive nine women to partner (40%) in 2015. Herbert Smith Freehills also made up six female partners, putting them in line with the 30% female partnership target they set to achieve in 2019, however this too was down from nine female partner promotions last year.

Focus on gender equality has not been far from these announcements, with Clifford Chance and A&O making up six female partners (25% and 29% respectfully) compared to Linklaters five. This was down on last year’s promotion round for A&O, who made up an impressive nine women to partner (40%) in 2015. Herbert Smith Freehills also made up six female partners, putting them in line with the 30% female partnership target they set to achieve in 2019, however this too was down from nine female partner promotions last year.

This is in contrast to Clyde & Co and Mischon de Reya, who also announced their promotions rounds in the past few weeks. Clyde & Co achieved parity in its number of female promotions, making up eight women in a record-breaking promotions round of 16 new partners. On the other hand, Mischon de Reya made up four female partners in a majority female promotion round, following on from its all-female promotion round in 2015. In 2014 the firm introduced ‘unlimited holidays’ and a new agile working policy in a bid to retain and attract talented female individuals.

At the same time, Macfarlanes were criticised in the legal press for their lack of female promotions, making up no women for the first time in three years. This is in contrast to previous promotion rounds, which have seen a minimum of 30% female partner promotions in recent years. In commenting on the promotions, Senior Partner Charles Martin noted that the round was a “large group by historic standards but one that is uncharacteristically and disappointingly lacking in women.”

In conclusion, it is encouraging that the proportion of women made up into partnership has become a cornerstone of this reporting. However as shown with Clyde & Co and Mischon de Reya, the actualisation of equal or majority female partnership rounds are dependent on the alignment of factors specific to a firms size, practice area focus and internal culture.

For a copy of our article A Path to Parity: Reassessing Gender Balance within UK Law Firms please contact research@fidessearch.com

2) Compliance failings at Mitsubishi Motors

Mitsubishi Motors has suffered another blow to their business due to a failure in compliance, something which the company has struggled to resolve after a number of shortcomings.

This week Mitsubishi Motors Corp. disclosed a manipulation in their fuel economy testing after Nissan found discrepancies in cars provided to them by Mitsubishi Motors. It seems the Japanese carmaker managed to publish improved fuel economy data by flattening their types to bring about lower mileage rates.

Company President Tetsuro Aikawa has been sincerely apologetic about the scandal, saying that although he was unaware of the fraud, he feels responsible. The false data has led to 625,000 cars having to be recalled and Mitsubishi shares plummeting by 33%, as reported by CNN Money.

The company have had an unfortunate history involving such quality lapses and recall failures, spanning over a decade. In 2000, Mitsubishi Motors announced that it had covered up safety defects and customer complaints about its vehicles, which led to the admission of broader problems going back decades and, in turn, the biggest automotive recall scandal of all time.

Mitsubishi’s regulatory compliance and internal oversight have hardly improved since these wrongdoings. The carmaker has failed in reinforcing a compliance culture into the business, something which Aikawa claims has been extremely difficult to instil into all employees. Nikkei Asian Review has remarked that failures in their internal chain of command and poor sharing of information is the root cause of their compliance failings.

This is just the latest scandal to hit the automotive industry, after Volkswagen were caught rigging emissions tests last year. The German carmaker came to an agreement this week with US regulators as part of the settlement regarding their emissions scandal. It was also announced today that fellow German carmaker Daimler, the owner of the Mercedes Benz brand, has begun an internal investigation into the way it certifies diesel exhaust emissions in the US.

Violations of regulatory compliance are a regular occurrence in the automotive industry. Regulators are becoming much more aggressive in enforcing regulatory frameworks and with increasing importance placed on reputational risk and preventing brand damage, carmakers in the industry will have to begin developing better approaches in ensuring compliance standards are met.

Movers and Shakers of the week

Appointments

Ashurst elects Australian managing partner

Finance co-head Paul Jenkins has been appointed the first Australian managing partner at Ashurst, taking over the role from James Collis in June

Royal Mail appoints permanent GC

Royal Mail’s interim general counsel Maaike de Bie has been confirmed as general counsel for the business

Moves

Gibson Dunn bolsters London corporate offering

Financial regulatory partner James Perry exits Ashurst to join Gibson Dunn & Crutcher’s London office

CC hire CMA director in an attempt to rebuild competition team

The UK Competition and Markets Authority’s director of mergers Nelson Jung will join Clifford Chance’s partnership in London, one week after the firm lost competition heavyweight Alastair Mourdant to Freshfields Bruckhaus Deringer

KWM lose two further partners

Darren Rogers and Patrick Williams leave King & Wood Mallesons for Ashurst’s real estate practice in London

Senior CC partner set to join Surrey law firm

Restructuring & insolvency partner David Steinberg is to join Stevens & Bolton, after 22 years as a partner at Clifford Chance

Office Openings & Closings

Central Asian-based firm enters Iranian legal market

Colibri Law has become the second international firm to set up Iran, opening its doors in Tehran

Partner Promotions

Clyde & Co promotes 16 to partnership, five in the City

Linklaters makes up 24 partners, 10 in London

Clifford Chance promotes 24 globally, with nine partners in London

Herbert Smith Freehills makes up 20 globally and seven in London

Is there something we can help you with?

If not right now, we can include you on next weeks' newsletter update?

CLICK HERE